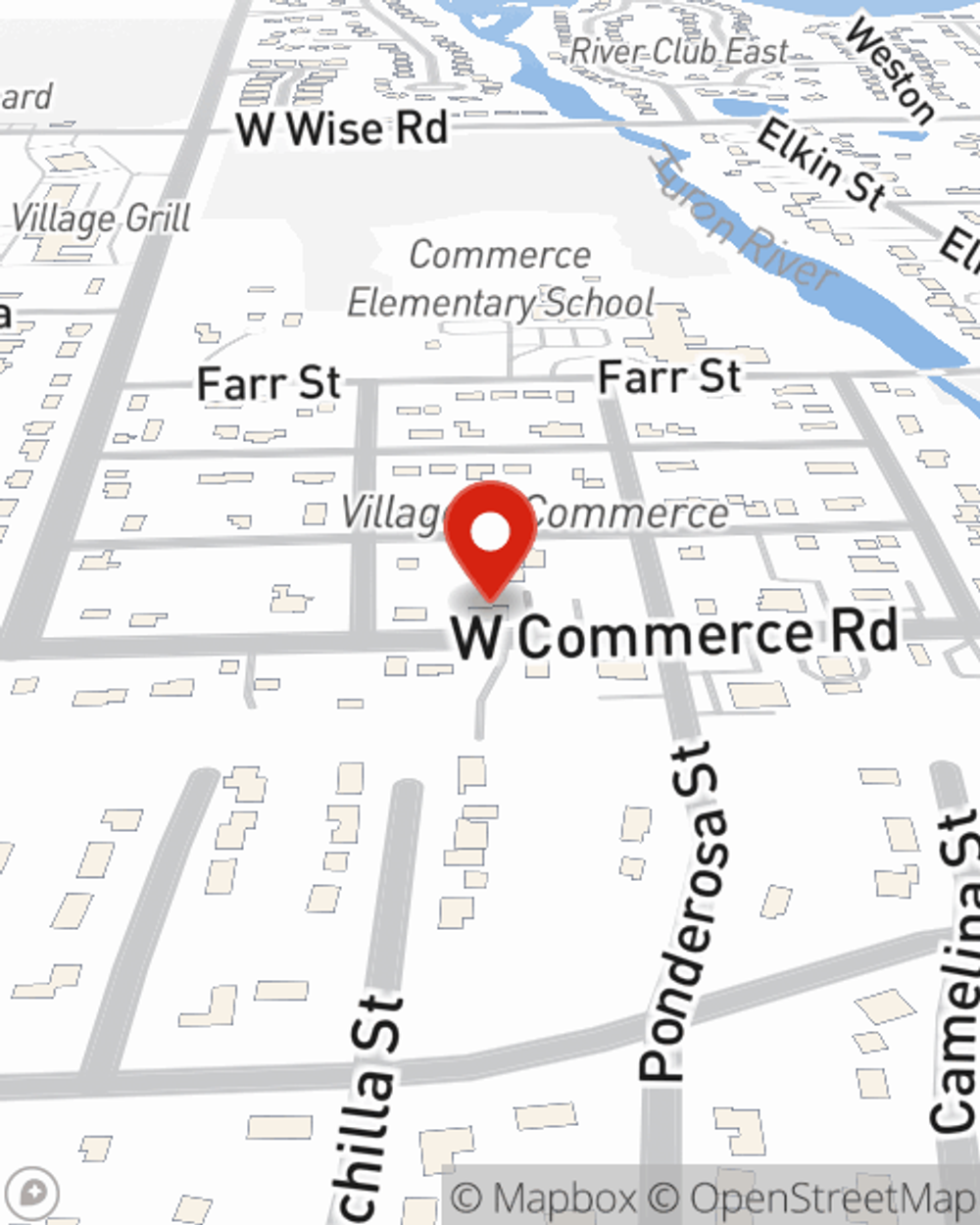

Business Insurance in and around Commerce Twp

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Your Search For Outstanding Small Business Insurance Ends Now.

As a business owner, you have to manage all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Sean Shewalter. Sean Shewalter relates to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your wages, but also helps with regular payroll overhead. You can also include liability, which is important coverage protecting your financial assets in the event of a claim or judgment against you by a customer.

Contact the outstanding team at agent Sean Shewalter's office to find out about the options that may be right for you and your small business.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Sean Shewalter

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.